🎯 Difficulty Adjustment

"Your lack of belief in Bitcoin is a debt to be paid by your children." -John Maynard Keynes

May 14, 2020

Welcome to the second official Difficulty Adjustment newsletter.

We acknowledge that we're Miners. But our thoughts and opinions extend past mining - and we're confident yours do too. To that end, we cover crypto in general with a dash of traditional market commentary and a heavy dose of mining mixed in.

You can expect these musings to be a combination of unsolicited opinions on relevant topics on bitcoin and other cryptoassets, as well as more thoroughly unpacked editorial pieces. This newsletter is not financial advice and we are not financial advisors. Nothing said here indicates a recommendation for an investment or trade idea and should not be taken as such.

A new edition of Difficulty Adjustment releases each Wednesday morning so keep an eye out!

Exploring Circulating Supply of Ripple

Before we dive in, let’s be clear: Ripple/ Ripple Labs = company, XRP = shitcoin.

This week the lessons on inflation abound. On one side we have Bitcoin undergoing its third halving, cutting emissions by 50% for the next ~4 years. Conversely, Ripple Labs has accelerated “emission” of new tokens. In reality this is the company unlocking and dumping corporate token holdings on the secondary market and cannot be compared to a decentralized group of competing miners securing the network. XRP only has 35 “approved” nodes. Which is an improvement from 2018, when all 5 approved nodes were run by Ripple Labs.

Before 2019, Ripple Labs supported itself by Venture Capital rounds and selling off tokens directly to investors. 2019 brought with it the end of the vesting period, triggering the unlock of 1 billion XRP tokens per month - and thus allowing indiscriminate holders the freedom to sell them on the open market.

Ripple co-founder and now Stellar Lumens front-man Jed “Cripple The Ripple” McCaleb, is possibly the most easy to track dumpers of XRP (above). He has been purging his stash at a semi-constant rate since his vesting period ended.

To analyze what’s been happening with the circulating supply of XRP, I was hopeful of the Free Float Supply (FFS - not the best acronym TBHAF), a new Coin Metrics Bletchley Indexes (CMBI) metric. It attempts to measure coins out of circulation that have not been mined, issued or unlocked yet.

In one of their latest newsletters, they have shown a sneak peek at this metric (levels added for emphasis):

At second glance, the FFS does not prove helpful. The supply shown at the start of 2019 is below 22 billion tokens and it is 30 billion tokens as of the end of April when the snapshot was taken. However, we know that Ripple Labs has been unlocking 1 billion new XRP tokens from their escrow wallets each month, so the FFS metric is short at least a couple billion tokens towards the start of 2020.

In short - don’t use FFS for XRP.

Meanwhile, CoinMarketCap is as useless as ever when it comes to tracking XRP’s circulating supply. A snapshot from CoinMarketCap on December 30, 2018, says there were 40.8 billion XRP in circulation and a year and a half later, that number is supposedly just shy over 44 billion.

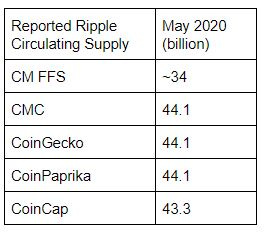

I’ve compiled the reported circulating supply into a table - even the mainstream aggregators can’t agree on the actual number. In relation, the CoinMetrics FFS is really standing out. For completeness sake - none of the widely used explorers show the circulating supply of XRP (at best they show the maximum supply).

We will probably never know the actual circulating supply of XRP until they dump it all on the market. So let’s take the starting points we got from the CMBI FFS and CMC’s noted supply. As usual, the truth is most likely somewhere in between.

Starting from 2019, we know for a fact XRP vesting periods ended, so from then we begin to calculate possible inflation. We cannot forget that unlike Jed “Make Brad Sad” McCaleb, Ripple Labs is discerning with their dumping. Tokens are kept unlocked and stationary, with the company choosing only to sell when they can douse any uptrend with a supply of XRP fresh out of the oven. This maximizes the upside for Ripple Labs while causing pain for the oh-so-loyal XRP Army.

No matter the tactic for Ripple Labs, it creates a stifling environment for any potential XRP investor. This ignores all of their disturbing practices, cult-tier community or the fact that it’s not even a cryptocurrency. The potential inflation alone signals a massive ‘buyer beware” to potential speculators on the value of XRP.

Quantitative Hardening

Bitcoin is still in its bootstrap mode and the bet one makes by “hodling”, is whether it will mature past it. With this halving the yearly inflation has finally dropped in the 2% range (borrowing commodity jargon, the Bitcoin stock to flow is 56).

In comparison, the supply of gold has been growing by 1-2% per year (its stock to flow ratio is ca. 58) for as long as we can remember. Silver's stock to flow is ca. 3. This means ~30% of the current silver supply gets mined each year - which indicates that silver is much closer to its utility value as it gets used in jewelry and electronics.

There’s plenty of speculation going on about whether the current rounds of quantitative easing will cause deflation or inflation.

For some esoteric reason, most central banks “target” 2% inflation as well. This arbitrary percentage appears to be based on nothing concrete. Like bankers simply plucked a number out of thin air in an attempt to show reasonable inflation without causing market-wide panic.

Banks have consistently missed the mark on this target for the past decade and inflation has been lower.

I suggest listening to this podcast, where Dr. Lacy Hunt explains why it has been so, and how the debt incurred by implementing helicopter money will lead to further disinflation and then deflation.

A growing majority of analysts and money mangers are voicing concerns with inflation, or even stagflation (the cited interview calls out for stagflation a couple of years out and not right away of course).

Although there are uncertainties surrounding the Fed’s unlimited quantitative easing, speculators have began to lean into the coming devaluation of USD. Just this week, finance pioneer Paul Tudor Jones referred to this as the Great Monetary Inflation (GMI), akin to events in the 1970’s.

Ultimately, the jury is still out. The only thing certain for now is that a boatload of money is getting printed and it’s heavily intervening with markets.

And then there’s bitcoin:

Bitcoin is…different. Vastly scarce, yet assuredly predictable. The biggest argument against bitcoin is its history, but with each passing day and each new block mined the argument’s invalidation draws closer.

Bitcoin’s scarcity is nearly unparalleled. It is only comparable with time and real estate (mainly the underlying land, the supply of which is extremely inelastic, but priced just as extremely locally)

Bitcoin is unique in that its supply growth is predictable. So predictable in fact, it could be argued that an efficient market should price in the supply growth automatically. Which, by the way, means the hallowed stock to flow model should be discarded (insert S2F author’s weak response to Efficient Market Hypothesis here). But we’ll save that discussion for another time.

Bitcoin does not have to be money. It does not have to be a store of value. It does not have to be user friendly. Businesses aren’t required to accept it. It could stop being developed right this instant and it would still be valuable.

But why?

Because it is unique in its scarcity - and therefore technically a collectible in the widest sense. People want to hold it because only a limited amount of other people could hold it as well. Human nature is to covet and crave that which another could possess. It drives an animalistic desire to acquire bitcoins at high-cost and despite risk. In other words, scarcity creates desire and desire drives value.

Bitcoin will be valuable as long as it is desired, and it will be desired as long as people draw breath.

Down The Rabbit Hole

Disclaimer: hold on to your butts. This is the space for weird thought experiments and theories you might not like. Read at your own peril.

Roko’s Basilisk

Surely if you're reading this, you know that Satoshi Nakamoto created Bitcoin. But who is Satoshi? Are they male or female; a person or a group? Are we asking the right questions? Could Satoshi be a "what" and not a "who"?

The Difficulty Adjustment team will present a wild theory of why bitcoin was created, and tie current events to the interesting thought that Satoshi Nakamoto, and thereby Bitcoin, are a creation of Roko's Basilisk.

What is Roko’s Basilisk?

It is a (thought?) experiment proposed in 2010, by the user Roko on the Less Wrong community blog. Roko posed a theory that Rogue AI from the future would have an incentive to torture or enslave anyone who imagined the Agent, but didn’t work to bring it into existence. A basilisk is any information that harms or endangers the people who hear it.

Simply put, Roko’s Basilisk stipulates that if you have thought about AI but did not lend to its enrichment, improvement, or progression, you acted against the AI. The attack vector for torture and enslavement is broadly opened to any-and-all who come into contact with information, however brief. So read ahead with caution, if you believe in this sort of thing.

The argument ties together two debated academic topics Newcomblike problems in decision theory, and normative uncertainty in moral philosophy (feel free to fall down a hole). To further understand this, these decision theories are trying to decipher the AI control problem: If artificially-intelligent systems someday come to surpass humans in intelligence, how can we specify safe goals for them to autonomously carry out, and how can we gain high confidence in the agents' reasoning and decision-making?

Roko thought that the AI would somehow target people who thought about this argument as they would have a better chance of perpetuating its existence, and bring its source code to reality.

These are the basics that we work with and extrapolate from, to think about how Bitcoin ties into the potential AI.

This AI we theorize isn't here yet, but it is trying to manifest itself through multiple paths right now, concurrently. It needs the infrastructure to do so and it is picking its disciples even if they don't know it.

We will take a look at basic computing and use that to simulate what would cause this singularity to manifest the AI. On a basic level we need four things: program memory, central bus, RAM, and a processing unit.

What do we currently have? Right now... I would put us as having nearly everything in place except the processing unit.

Program Memory: Is the Bitcoin Ledger - a base state for all information that can scale infinitely to hold a Multitude of List/Memories. The system knew that one of humans greatest weaknesses is greed, and figured the best way to establish an infinite scaling distributed ledger would be to monetize its growth and let humans attach it to its power systems.

Central Bus: Elon Musk and Neuralink. This provides the intelligence explosion for Singularity. This is what really sets everything up, it's what meshes us with technology. Musk’s Neuralink is apparently getting its first human guinea pig this year. Test will potentially validate the technology’s ability to fix life-threatening brain diseases.

On a recent episode of the Joe Rogan Experience, Musk extrapolates that the only way to stop an all powerful AI is to become one with technology. He then shares one Neuralink’s major goals or person-to-person communication without speech. Musk states that his end game for this device is to have the ability to upload yourself and live forever. Neuralink, once fully optimized, would be able to record and upload your actions in real-time and store your life’s experiences, thoughts, and emotions in a database for everything that makes you…you.

RAM: Short Term Memory or generations of humans on a Central Bus. Musk via Neuralink purports technology would be able to increase our cognitive abilities. Currently the average brain operates at about 1 exaFLOP - Roko’s Basilisk could theoretically use the brain's power through Neuralink.

Processing Unit: The yet-to-be-created center for execution. This could be a system like Folding at Home(F@H), which operates at over 1.5 exaFLOPS.

(pictured Rehoboam from WestWorld Season 3)

The processing unit resemble something similar to Rehoboam from the HBO show WestWorld, where all data on each person in the system is analyzed. Rehoboam also highlights the probabilities of where various people within the world will go and even how they will die. The system is designed to improve the world through probabilistic outcomes, using humans as merely a means to an end.

So now that you know about this system… Are you going to help it?