Difficulty Adjustment

"One must await six confirmations before considering an opinion to be fact." -Aristotle

May 6, 2020

Welcome to the first official Difficulty Adjustment newsletter.

We acknowledge that we're Miners. But our thoughts and opinions extend past mining - and we're confident yours do too. To that end, we cover crypto in general with a dash of traditional market commentary and a heavy dose of mining mixed in.

You can expect these musings to be a combination of unsolicited opinions on relevant topics on bitcoin and other cryptoassets, as well as more thoroughly unpacked editorial pieces. This newsletter is not financial advice and we are not financial advisors. Nothing said here indicates a recommendation for an investment or trade idea and should not be taken as such.

A new edition of Difficulty Adjustment releases each Wednesday morning so keep an eye out!

News with attitude:

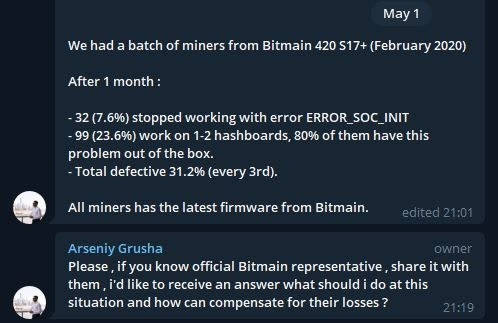

The most interesting recent piece of news that reached us is that after the blunder of S15 failure rates, S17 is again a buggy brick.

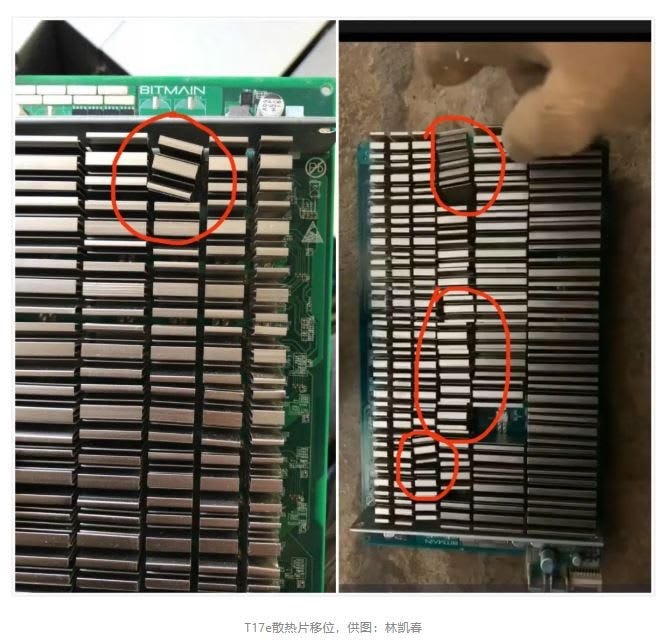

The piece reached the west after Samson Mow tweeted that the S17/T17 have 20-30% failure rate, with the source of the problem being loose heat sinks and failing fans.

Original Source in Chinese.

After further review it is clear that Samson's tweet is an opinion based on an opinion. Samson may have specific personal data to draw from based on Blockstream's business but that is impossible to derive from his tweet. The article cited is clearly the opinion of its author, expressing personal disappointment with Bitmain's high failure rate.

On the latest episode of the Hashr8 podcast, Matt D’Souza has mentioned a 17-18% failure rate for one batch of S17’s and a 1% failure rate for a second batch (after it went through an intermediary which checked for quality).

For anyone who cares to look, these anecdotal experiences have mostly been contained to social media, rumors and ASIC chat rooms. The failure rates seem to be batch-specific and not model-wide.

The questions that present themselves:

Is this Chinese article indirectly trying to discredit Bitmain? (Maybe)

Is this a blog post rather than an actual unbiased article? (Yes)

Did Samson twist the narrative against Bitmain, or were details lost in translation? (Up to the reader to decide)

Are the S17’s actually problematic? (Yes, but we don’t know the extent)

Whatever the motivation, nuance was lost in translation between the Chinese article and Samson's tweet. Afterwards, western “news” uncritically reported second hand information, without any deeper fact checking.

The market momentum and narrative has been against Bitmain for quite some time. At this rate, their market share will keep sliding down. It is baffling that they have yet to provide an overwhelming response to such claims.

Even though S19 is promised to be the most efficient machine on the market, can you trust Bitmain’s claims if the last two generations of their machines allegedly had failures at the rate of double digits in percentages? Couple that with the apparent lack of customer care.

Meanwhile, MicroBT is hitting their stride and capturing market share. Whatsminer's have been well-received and feedback is overwhelmingly positive.

They have released three new models ahead of the Bitcoin halving, with efficiency almost at the level of the new Antminer S19. However, the fact that 3 out of 10 MicroBT ASICs of the last gen haven’t turned into glorified bricks after 6 months of running, kinda skews the expectancy of their efficiency in Whatsminers favor.

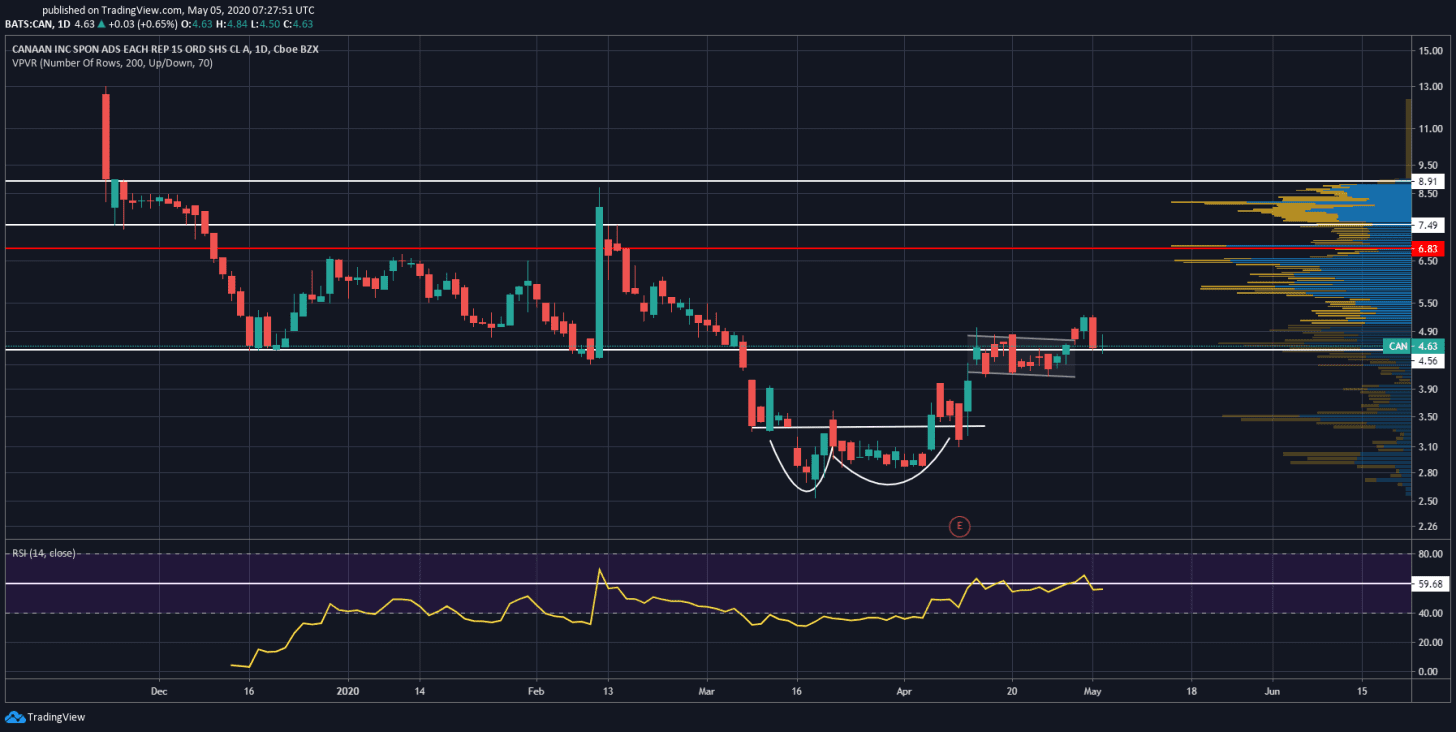

Although Canaan is getting slapped from multiple sides by allegations of misleading investors, it is the only publicly-traded ASIC producer. Just the fact that it is publicly traded, as opposed to its competition, might be a boon, because it’ll force the company to act with at least a bit of transparency instead of trying to fleece its customers left and right (which is absolutely the perception of Bitmains behavior).

Although counterintuitive, the Canaan stock has been trending up after the sad 2019 earnings (the irony of dissing Cointelegraph and then quoting it a couple paragraphs later is not lost on us).

That said, when new model, Canaan?

Separating politics from the truth:

Despite putting myself in a (clearly unsuccessful) social network quarantine, almost every day I run into either an opinion piece or an article, which claims something about the current COVID-19 crisis.

As said by the epidemiologist Marc Lipsitch, there are:

a) facts

b) informed extrapolations from analogies to other viruses

c) opinion or speculation

The problem with the current crisis? The politicization of the data and therefore corruption of facts.

When facts become opinions, everything turns into speculation (let's not forget that in such an environment, populism thrives).

The counterculture around cryptocurrencies is used to both uncovering lies and being hypercritical of news we're fed (partly from the inherited cypherpunk paranoia, partly from all the scams lurking about, partly from bad Chinese translations).

However, this is the first time I remember the general public being paranoid about the information they are given. Nobody trusts anything or anyone. All news is fake, all studies are warped, all stories are conspiracies - and this seems to be the general consensus. The well of gullibility is spilling over. This comes at the time of the greatest interconnectivity the world has ever seen. We can be fed lies from all over the world in an instant. It is not the most factual story that spreads. It is often the news that is the most memetic, which can capture our interest the best.

There is a weird, growing disconnect in people – we know what we're being shown are lies, yet we keep pretending everything is fine. The term best describing the reality we live in is hypernormalisation, a term used to describe the surreality of living in the Soviet Union where all goods were produced at 115% the planned rates and yet the grocery shelves were empty.

In the past, lies were presented as the truth. Now, the battle front of this hybrid war has shifted - we are presented opinions as facts. The problem is, people have noticed and they are not happy.

This raises many questions about our collective future. Some that are relevant here are:

If you stop trusting the government of your country (and the currency you use is guaranteed by that country), does the form of money you trust transform into something else?

And the follow-up:

What is the terminal percentage of population necessary to make something alternative a widely usable medium of exchange (=money)? Is an intolerant minority enough?

For completeness sake, we know what the alternatives are – gold and crypto are the only trustless forms of money in existence right now, with the former being cumbersome to transport and unscalable and the latter being cumbersome to use and frankly, too new to be trustworthy (isn’t it fun that even though Bitcoin is a trustless form of money in its function, it needs the trust of people in that function to be useful?).

Gold probably cannot be “fixed”. It is what it is and does its function fairly well. It is a conservative, orthodox store of value and not a medium of exchange (anymore). It is inert in more ways than one.

On the other hand, crypto is evolving constantly, and each year it survives provides more trustworthiness. It is also by definition global since it doesn’t recognize borders. That means it should be easier to build a large enough population of regular users and a parallel economy which runs independently of the regular fiat economy.

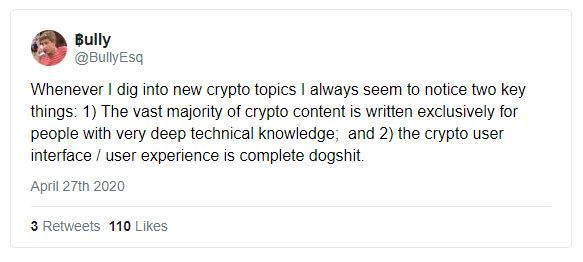

As always succinctly put and then deleted by Bully:

The other ingredients are there. All we need is better UI/UX in places other than exchanges.

Afterthought:

Apply “All news are fake, all studies are warped, all stories are conspiracies.” to the Bitmain heatsink failure story.