Over $650 Million Earned by Bitcoin & Ethereum Miners In August!

Price and fee increases fuel revenue rise for Bitcoin & Ethereum miners

This newsletter originally appeared on HASHR8.

Thanks to Ledn.io for sponsoring this newsletter release.

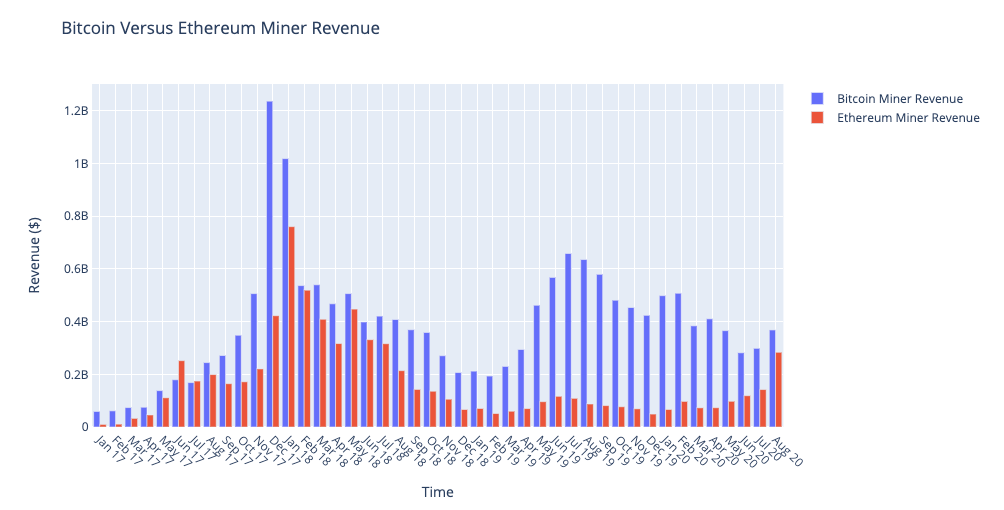

Bitcoin and Ethereum miners collectively brought in over $650 million in revenue for August. Bitcoin miners earned their highest monthly revenue since April while Ethereum miners almost doubled their revenue month-on-month.

A rise in Bitcoin price was the dominant driver behind the increase in revenue for Bitcoin miners. Hashrate failed to keep pace with two small upward difficulty adjustments occurring during the month.

The picture was entirely different in Ethereum with an extraordinary spike in fees being the dominant driver behind the rise in revenue. Daily fees reached record levels of over $17 million on September 2nd.

Transactions on Uniswap v2 and with USDT were the biggest consumers of fees. Fees hugely boosted Ethereum miner revenue and accounted for as high as 73% of the daily block reward.

We analysed the revenue earned by Bitcoin and Ethereum miners over recent weeks and months. We highlight the key drivers and showed how the revenue matched up historically. Access the full article by clicking on the below button.

Bitcoin Market Movements

Blocks are coming at a rapid pace and difficulty is estimated to rise by approximately 10% at the next adjustment. This is indicative that significant hashrate has been added during the current difficulty epoch which is likely the result of miners receiving shipments of latest-generation rigs.

Price appreciation vastly outpaced hashrate growth in August widening the margins of miners. With the fast-paced blocks suggesting that miners are finally deploying new rigs, miners will experience the opposite to what they experienced in August.

Bitcoin price recorded a sharp sell-off at the start of September which will drop the top-line revenue miners are generating. Furthermore, fees paid by users have recently dropped which may be due to less market speculation after the price decline.

On the bottom-line side, the significant jump expected at the next difficulty is expected to significantly push up costs resulting in margins tightening. After several drops below $10k, Bitcoin price has been recording a recovery in recent trading days which will alleviate the tougher conditions.

(Source: Tradingview.com)

Bitcoin Mining Industry Developments

Wu regains legal representative position at Bitmain. Official Chinese records were updated on September 14th to show that Jihan Wu has once again become the legal representative and executive director of the operating entity of Bitmain. This is the latest development in a toxic battle for control between Wu and fellow co-founder Micree Zhan. The battle between the two co-founders has severely damaged the firm’s brand and also resulted in a significant loss of customers. A legal case in the Cayman Islands – where Bitmain’s parent entity is domiciled – is ongoing between Wu and Zhan.

A Kazakhstan minister noted that the country is currently negotiating over $700 million investment in crypto mining infrastructure. According to Reuters, Digital Development Minister Bagdat Mussin addressed the government stating that the country has secured “preliminary agreements” on attracting the equivalent of $714 million in investment. Mussin further noted that $190 million has been invested in crypto mining infrastructure within Kazakhstan to date and that there are thirteen mining farms currently operating in the country. Four more are reported to be under construction.

Bitcoin Cash miners intend to implement an Infrastructure Funding Plan (IFP) which will redirect 8% of each coinbase reward to an entity controlled by Bitcoin Cash ABC stakeholders. The motivation behind the IFP is to fund Bitcoin Cash infrastructure development. The proposal is part of the next upgrade on November 15th but it has received mixed feedback from the Bitcoin Cash community. Miners who support the idea intend to orphan any blocks that don’t adhere to the IFP. Those who oppose the proposal have launched a new node client – BCHN – which will follow the chain with the most proof-of-work regardless of whether it contributes to the IFP. More than 50% of Bitcoin Cash blocks recently mined have signalled that they’re using the BCHN node client. The upcoming upgrade is setting up to be a contentious one and the odds of a further chain split are rising.

HASHR8 Podcast

Guillermo Ruiz Hernaiz joined the podcast to share his experience establishing mining operations in both Kuwait and Kazakhstan. Guillermo and his team intend to set up their next facility in Paraguay. Guillermo details the advantages and disadvantages of mining in each of the three regions.

This Difficulty Adjustment Release was Sponsored by Ledn

Ledn offers a suite of institutional-grade services that can help you manage and optimize your digital wealth. Ledn works with Genesis, the most established institution in digital assets, to offer its clients access to Savings and Credit products at industry-leading rates and with unprecedented transparency.

Ledn's Savings Accounts offer the best rates in the industry for Bitcoin and USDC at 6.5% APY and 10% APY respectively. Their bitcoin-backed loans provide its retail and business clients with access to liquidity without having to sell their bitcoin. And their B2X loans let clients double the amount of bitcoin they own through a bitcoin-backed loan.

Check out how you can make the most of your digital wealth at Ledn.io.

About HASHR8

We are a modern media and Bitcoin mining company focused on driving the mass adoption of cryptocurrency. Our research analysts and content creators strive to provide actionable and engaging content on the most relevant industry topics.

For more information, to submit a story for review, or to share a newsworthy tip, please email us at media@hashr8.com.