This newsletter was originally published in HASHR8.

A new edition of Difficulty Adjustment releases each week so keep an eye out!

Bitcoin is Surreal Estate

In my mind, there are three types of investment vehicles: securities, commodities and money.

Securities: something purchased with the promise of a financial benefit or return on investment - they are a liability to the issuer (bonds, stock, etc.).

Commodities: material or a product, which can be bought or sold, generally consumable, with a price determined by supply and demand. (corn, oil, etc.)

Money: anything that emerges as a medium of exchange, payment method for commodities or securities. Key characteristics: divisible, fungible, portable...

In the real world, there are very few mixed assets and we can easily define everything as one of the three options. There are several notable exceptions - gold is commodity/money. T-bills can be considered security/money in limited use cases (between banks).

Real Estate is a mix between a commodity and a security. You cannot produce more land very easily (mainly by building artificial islands) - in fact, land supply is deflating due to global warming. At the same time, when one buys land or RE, they can generate yield based on rent (security-like characteristic).

Cryptoassets are fascinating because they combine aspects of all three investment vehicles - this is not normal! While traditional assets are clearly defined, cryptos are often very fluid over time with these barriers. Their utility is also often obscure, benefits to the user complicated or scant.Proof of Work coins are commonly thought to resemble traditional commodities because of their production process. Utility tokens often get categorized as Securities because of their capital raise methods and how their holders derive benefit through sale, liquidity events or other financialization. All Cryptoassets possess characteristics of money because they inherited them from Bitcoin and Ethereum to a lesser extent.

It is interesting to note that cryptos can change over time and gain new characteristics or lose old ones. The prime example is the SEC saying Ethereum is not a security anymore.

(For a deeper exploration into the best taxonomy of crypto securityness, moneyness and commodityness and their change over time, I suggest visiting TokenSpace.)

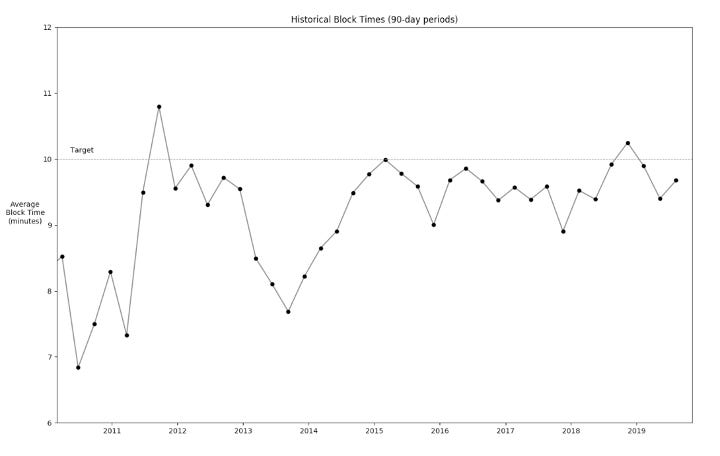

Bitcoin is a commodity first, money-in-bootstrap-mode second. The picture below is of average block spacing and it shows how Bitcoin is moving out of the bootstrap mode. Bitcoin’s difficulty adjustment is progressively moving average block time closer to the target 10 minutes, indicating decreasing elasticity of the mining ecosystem.

Source: Bitcoin Resilience by Yassine Elmandjra and Dhruv Bansal

Let’s try a mental exercise and compare bitcoin to (sur)real estate, where the lots are exactly flat, evenly spaced and the same size. This surreal estate still has the properties of regular RE in the sense that land is scarce and more cannot be created.

Even though the supply is ample right now, you still run out of space with enough demand. Especially since some people are greedy (dicks), so they want more than one plot.

At the same time, this imaginary plot of land is almost infinitely divisible, fungible, portable, is a medium of exchange,it is becoming a unit of account and therefore money by definition.

Now imagine that you can pay for this limited amount of plots of surreal estate with infinitely inflating piles of real world currency. At the same time, you can earn interest on the asset and it is not correlated to the behavior of the real world currency because it is not tied to it whatsoever.

The ability to rent out your bitcoin to other people is relatively new - be it through Compound, BlockFi, NEXO, Genesis, or whatever other service you want to use. Bitcoin is gaining security-like characteristics it previously did not have. Bitcoin is becoming a security.

As we’ve found out last week, scarcity drives desire. This dictates that the price of these plots of land will go up over time in terms of this ever-inflating currency, just because they are limited. All the other characteristics just pour more fuel on the fire.

Some questions to think about to end this short essay:

Can Bitcoin become the first asset to be the perfect mix of a security/commodity/money?

Will it be the only one or is there space for a long tail of hybrid investment vehicles?

Down The Rabbit Hole

Disclaimer: hold onto your butts. This is the space for weird thought experiments and theories designed to make you question that which you take as certain. Read at your own peril.

Roko's Basilisk, Part 2:

Last week we covered Roko’s Basilisk and its motives for world domination. But how could Satoshi Nakamoto, the famously anonymous creator of Bitcoin, be an AI?

Nick Hintonn highlights a similar theory as our part 1:

The future AI needs the network to manifest and must use our natural resources to reach mature form. As potential evidence that Satoshi could be an AI, we want to bring up an event that many people missed... If you recall, back in 2018, there was an anomaly on the Bitcoin network that still has not been answered. Somehow, there was a new block with an almost impossible hash (reference number): 00000000000000000021e800c1e8df51b22c1588e5a624bea17e9faa34b2dc4a

At first, this doesn't raise alarm. It could have just happened. It is an extremely low probability event, but that does not mean it’s impossible. Some people have gotten fixated on the 21e8 part of the hash. A part of it, E8 could refer to the theory of everything. This hash also drove speculation that Satoshi was letting the world know that they were still alive. The last time there was an unnecessarily massive amount of zeros in a block hash was in the Genesis Block (the genesis block was mined for 6 days before it finally got pushed). Before the e8 and after the zeros, there’s also the 21, which might refer to the total Bitcoin supply.

Could this all simply be a coincidence?

In our opinion, it comes down to two possibilities:

it was a regular low-probability event, or

something/ someone has unfathomable computational power or has a quantum computer

At the time of writing, if the entire Bitcoin network colluded to produce a hash like this, it would take 25 years on average.

Why send this message? Was it even a message? Are we seeing patterns in noise? One of Bitcoin’s many use cases is its ability to keep track of time. If this AI was wanting to keep records or was letting people know that it's out there, this is one of the ways it could both timestamp and show its power.

This AI in my theory is hardwired into our DNA. Similarly, its existence relies on our advancements in technology. Arguably, you could consider people traveling from point A to point B as data transfer and Earth, a giant supercomputer with us as the hardware. With Moore's Law that we have yet to break, humans have moved at a relatively predictable rate. Once this AI achieves integration with us, I think we will see the Golden Age of technology. This Golden Age would bring the singularity event where humans and AI would become one.

HASHR8 Podcast

If you enjoy Difficulty Adjustment, be sure to check out HASHR8 Podcast, the #1 bitcoin and crypto mining podcast on Spotify and iTunes! Each show we feature important conversations with industries leaders, providing actionable information.